About the Company

The client is a global industrial automation manufacturer headquartered in Frankfurt, Germany, serving Fortune 1000 enterprises across automotive, energy, and heavy engineering. Operating in 35+ countries, the firm delivers robotics and smart-factory solutions that modernize high-volume production. Despite category leadership, the team struggled to communicate business outcomes to non-engineering stakeholders who approve budgets and set priorities. Digiwigy was engaged to translate technical depth into executive clarity and to structure education across the buying committee.

Accelerate education across decision committees and reduce mid-funnel friction by 30%.

The Challenges

Visibility wasn’t the issue—comprehension was. The brand generated interest but lost momentum when conversations shifted from “how it works” to “why it matters.” Non-technical leaders needed a clear, staged explanation of value, payback, and risk, supported by credible perspectives. Content arrived out of order, mixed personas, and repeated messages, creating friction for evaluators and procurement. Digiwigy isolated three obstacles that consistently slowed progression.

Technical Complexity Blocking Executive Understanding

Product materials emphasized architecture, sensors, and protocols, assuming fluency with automation economics. CFOs and COOs lacked a translation layer that connected capabilities to throughput gains, labor reallocation, quality improvements, and working-capital benefits. Without plain-language, evidence-backed explanations, committees deferred decisions, prolonging trials and diverting budget to lower-risk incremental initiatives.

Unstructured Buyer Journey and Mis-Sequenced Content

Assets weren’t mapped to stage intent. Early visitors received dense spec sheets; late-stage evaluators saw generic awareness blogs. Sales shared ad-hoc links, duplicating messages and skipping prerequisites. The absence of a deliberate narrative—problem, options, evaluation, proof—created cognitive overload and inconsistent signals in CRM, degrading nurture logic and sales forecasting.

Weak Leadership Visibility during High-Stakes Evaluations

Competitors’ executives shaped the conversation via articles, panels, and forecasts. The client’s leaders were largely absent from public debate on factory modernization and sustainability, limiting perceived authority. Without leadership voices framing trends and risks, buyers leaned on external analysts for direction, diluting the brand’s influence in late-stage consensus building.

The barrier wasn’t demand generation—it was shared understanding across the buying committee.

How did Digiwigy help?

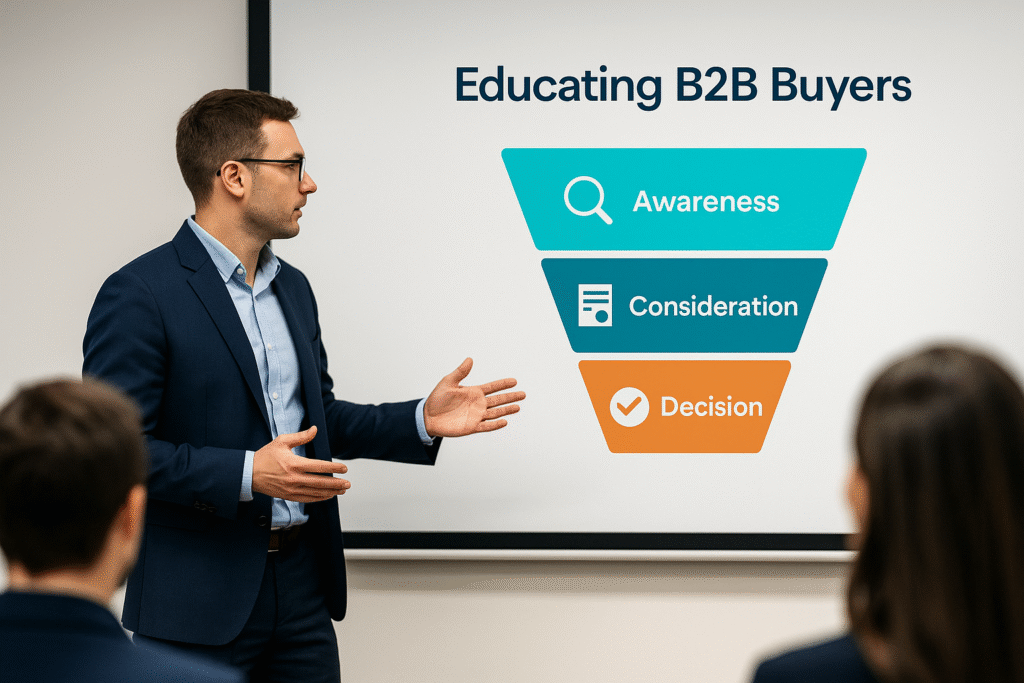

Digiwigy connected awareness, consideration, and decision-stage learning into one cohesive journey. We paired a disciplined content architecture with leadership-led education to make complex ideas simple, credible, and sequenced. The result was a repeatable system that advanced understanding, created trust, and gave sales measurable leverage in high-value conversations.

Built a Funnel-Aligned Content Engine

We redesigned the content architecture so every asset had clear stage intent and a defined next step. For awareness, we produced executive-readable explainers and market maps that quantified operational stakes. For consideration, we created ROI frameworks, implementation playbooks, and peer comparisons that modeled payback scenarios by plant profile. For decision, we shipped procurement guides, risk checklists, and outcome calculators. All assets lived in a searchable resource hub with internal links, intent tags, and analytics to track progression. The engine turned scattered materials into a guided education path buyers could follow without hand-holding.

Activated Leadership as Industry Educators

We repositioned senior executives as visible advocates for modernization. Ghostwritten op-eds, LinkedIn perspectives, and panel recaps articulated views on productivity, workforce upskilling, and sustainability compliance—using accessible language grounded in data. Each piece connected to hub content, reinforcing the learning path and signaling authority during evaluations. PR and social amplification ensured the right audiences—plant leaders, finance, procurement—saw leadership perspectives at pivotal moments. Over time, executive visibility reframed the brand from “advanced vendor” to “trusted advisor,” strengthening credibility and accelerating committee consensus.

The Results

increase in MQL-to-SQL conversion

higher engagement among executive readers

faster progression through mid-funnel stages

$8.6M influenced pipeline within two quarters.

25% longer average session duration on hub content.

31% lift in resource downloads and guided next-step clicks.

40% reduction in sales education cycles

18% higher close rate on automation solutions.

Improved marketing–sales content utilization in CRM.

Increased analyst mentions and leadership invitations to panels.

The Key Takeaways

In manufacturing, the winning differentiator isn’t another feature—it’s a shared understanding of value. When education is sequenced and led by credible voices, buyers progress with confidence. Digiwigy’s approach shows how structured narratives convert complexity into clarity, reducing friction and turning interest into predictable revenue acceleration.

Simplified narratives accelerate executive buy-in.

Executives don’t purchase control logic; they purchase certainty about outcomes. Translating automation capabilities into plain-language stories—throughput, scrap reduction, labor redeployment, safety—helped committees visualize gains and de-risk investment. This clarity replaced technical debate with business alignment, compressing time to internal consensus and improving approval rates.

Funnel precision improves progression quality.

Stage-intent content prevents repetition and confusion. By giving each asset a job—educate, evaluate, validate—and linking to a logical next step, buyers advanced without hand-offs failing. Precision reduced nurture drift, improved CRM intent signals, and enabled sales to join later with higher-quality, better-informed conversations.

Leadership visibility multiplies trust and speed.

When executives lead the conversation with data-anchored viewpoints, stakeholders perceive lower risk and higher strategic fit. Consistent thought leadership complemented the hub’s education, strengthened analyst perception, and signaled reliability to procurement. The combined effect: faster consensus, fewer “no decision” outcomes, and sustained differentiation against larger incumbents.